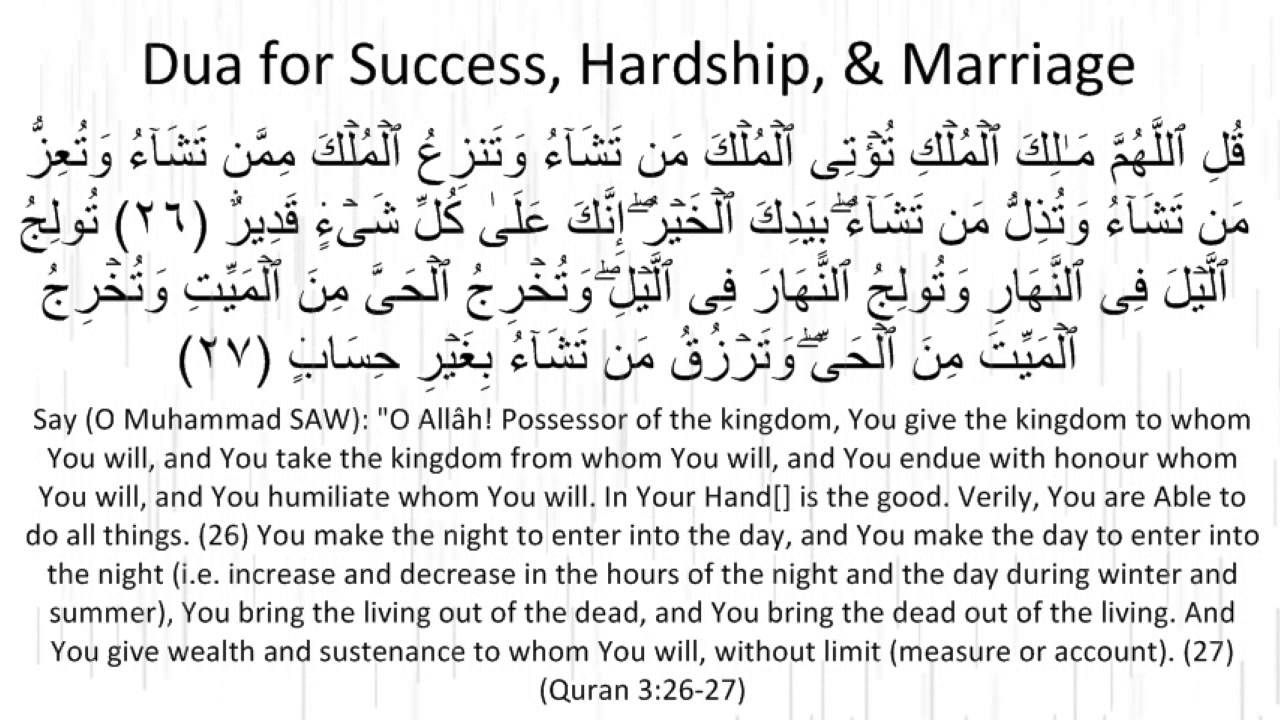

Riba in Islam implies an increment in a specific thing. The word is derived from a root meaning increase or growth. Allah, may He be exalted, says (understanding of the importance)

Riba is haram (unlawful) in all of its aspects, as the Prophet Mohammed ﷺ said (Muslim),Allah has cursed the one who consumes riba, the one who gives it, the one who witnesses over it, and the one who writes down the transaction.

The Prophet Mohammed ﷺ warned that consuming riba is one of the seven sins that doom a person to Hell. (Bukhari and Muslim)

“Whatever you pay as interest with the goal that it may increase (li yarbu) wealth of people does not increase (fa la yarbu) in the sight of Allah” [ar-Room 30:39]., i.e., it doesn’t increase or rise in status before Allah.

Riba began among the people of the Jaahiliyyah; if an obligation got to be expected, they would say to him (the borrower): Give us one hundred (that is expected, now), or increase it to one hundred and fifty (and pay later). At that point when the one hundred and fifty got to be expected, they would say: Give us one hundred and fifty (now), or increase it to two hundred (and pay later) and so on.

Riba Al-Fadl :

Islam likewise forbade another sort of riba, to be specific riba al-fadl, which means adding to the sum while trading one thing for one more of the same sort.

So if gold is sold for gold, that is not reasonable with the exception of like for like, hand to hand. Islam stipulated that the trade ought to be done hand to hand and that the things or commodity ought to be of the same quality. Whoever gives more or requests more has occupied with riba. On the off chance that he sells a saa’ of wheat for two saa’s (of the same commodity), regardless of the fact that it is hand to hand, he has occupied with riba.

Mudaarabah (Profit Sharing) :

There is nothing wrong with the principle of the circulation of capital if the capital is invested in trade or business, and the profit is shared between the owner of the capital and the worker. This is called mudaarabah (profit sharing), and there is nothing wrong with it if the capital is kept distinct from the profit. If this money is deposited in a riba-based bank, then taking the interest is haraam and it is not permissible to consume it. It is not permissible to deal with these banks, and loans based on interest are not permissible. It is also not permissible to accept payment in that currency for any job if that job helps to support a system that is based on riba.

With regard to using this currency (such as the dollar), there is nothing wrong with doing so in the case of necessity, even if that leads to helping to advance the economy of that country. That is because the dollar is accepted in most Muslim and other countries, so it is permissible to deal with it because of necessity. But if there is an Islamic currency that is used, then we can do away with the dollar.

The philosophy shows that a person who takes interest does not gain anything in reality but through the explanation of the Qur’an verse,

” Allah decreases interest and increases sadqah”

A Haadith on Interest ( Riba dalam islam) :

Hazrat Abu Hurairah radiyallahu anhu reported that the Holy Prophet sallallahu alaihe wasallm said: A time will certainly come over the people when none will remain who will not devour usury. If he does not devour it, its vapour will overtake him.

Hazrat Abu Hurairah radiyallahu anhu reported that the Messenger of Allah sallallahu alaihe wasallm said : Usury has got seventy divisions. The easiest division of them is a man marrying his mother.

Hazrat Abu Hurairah radiyallahu anhu reported that the Messenger of Allah sallallahu alaihe wasallm said: I came across some people in the night in which I was taken to the heavens. Their stomachs were like houses wherein there were serpents, which could be seen from the front of their stomachs. I asked: O Jibril! Who are these people? He replied these are those who devoured usury.

Related Link:

Riba

Usury

Interest